Looking for finance tips to help you get more from your money? Good idea.

Learning how to manage your finances isn’t easy. For starters, there’s so much to think about: Budgeting, debt, credit, savings, spending, interest rates… it never seems to stop.

And then there are our emotions – because let’s face it, everyone has a few hangups when it comes to money, right?

Some of us just get plain stressed whenever we think about the importance of personal finance. Others can’t think of anything worse than budgeting. And plenty of people get sidetracked by the next new finance craze, like crypto-currencies or peer-to-peer lending.

So, if you want to learn how to manage money better, here are 30 personal finance tips.

How to Manage Money Better

Let’s start with some personal finance basics. Here are a few essential money management tips for laying the foundations.

1. Create a Budget

This is arguably the most essential piece of money advice out there: Make a budget (and stick to it).

The author John C. Maxwell explains budgeting perfectly, “A budget is telling your money where to go instead of wondering where it went.”

→ Click Here to Launch Your Online Business with Shopify

2. Stay Organized with Budgeting Apps

Learning how to budget your money is not an easy task, so why not make it easier for yourself?

Another top personal finance tip is to use budgeting apps. These apps can help you bring all of your finances into one simple dashboard.

Check out top budgeting apps like You Need a Budget, Wally, and EveryDollar.

3. Create a Financial Calendar

Okay, if you’re like many people, this list may already be making you anxious! If that’s you, it’s okay – you got this.

Plus, this personal finance tip isn’t as scary as it sounds.

To create a financial calendar, set reminders for important financial tasks, such as paying quarterly taxes and checking your credit report. This quick financial tip can help to save you a ton of hassle down the road.

4. Track Your Net Worth

Your net worth is the total sum of your assets minus the total sum of your debts.

For example, say you have $1,000 in the bank, a car worth $1,000, and $500 of credit card debt. Your assets are worth $2,000, and your debts are $500. So, your total net worth is $1,500.

Monitor your net worth and keep trying to improve it.

If you have a ton of student loans, it’s not uncommon to have a net worth of –$100,000. If this is you, don’t stress – just take it one step at a time.

(Oh, and remember that your net worth is not how much you’re worth as a person – you’re worth more than you can imagine!)

5. Don’t Make Impulse Purchases

Everyone makes impulse purchases from time to time, but they can quickly drain your bank account.

So, the next time you see something you just ‘have’ to buy, wait a week before you hand over your cash.

The time will give you room for some perspective. Then, if you still want to buy it, you’ll know it’s definitely worth your money. Chances are, you’ll decide to keep your money.

As the cartoonist and journalist Kin Hubbard said, “The safest way to double your money is to fold it over and put it in your pocket.”

Personal Finance Tips to Manage Debt

Now, let’s check out some simple money management tips to help you deal with debt.

6. Get Clear About Your Debt

Gulp. Really? Yep.

Start by writing down the total amounts of everything you owe, as well as the interest rates, monthly minimum payments, and any loan payback lengths. Then, keep this document up to date.

Remember, knowledge is power.

7. Understand Interest Rates

Interest rates are significant.

They determine which debts to pay off first and which credit cards to avoid. They also help us understand how debt works – compound interest is a cruel master.

I mean, even Albert Einstein noted the importance of the concept: “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

So, make sure you understand the interest rates that affect your finances.

8. Pay Off Your Debt

When tackling debt, there are two main personal finance strategies:

- Avalanche: Keep up with minimum payments on all of your debt, but focus on paying off the debt with the highest interest rate first. This method aims to reduce the amount of money you pay back overall.

- Snowball: Focus on paying off your smallest debt first, regardless of the interest rates. Although you may pay more overall, the sense of empowerment and achievement could help you pay off your debts faster.

Credit Tips for Financial Success

Here’s some money advice to help you make credit work for you instead of against you.

9. Avoid Debt and Learn About Credit

Here’s a piece of essential personal finance advice: Avoid debt. As Thomas Jefferson, the third President of the United States, said, “Never spend your money before you have it.”

Still, in a few situations utilizing credit can make sense.

When used effectively, it can help you purchase a house, a car, or manage your medical bills. However, when used irresponsibly, it could spiral you into a mountain of debt that will rob you of the future you want.

No pressure.

So, whatever you do, make sure you understand how credit works, in detail.

10. Track Your Credit Score and Report

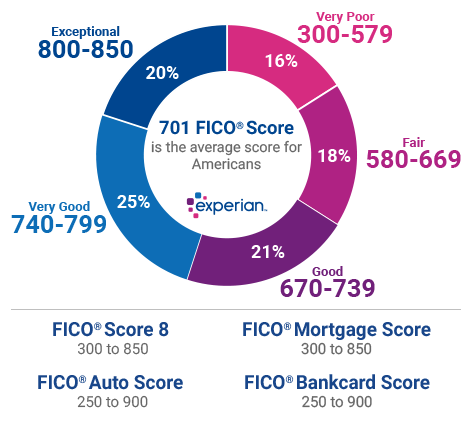

Your credit score can have a massive impact on your ability to rent somewhere to live, purchase a car, get a mortgage, or even sign up for basic utilities. So it’s vital to understand how credit works, and check your score and report regularly.

Ideally, you need to get your credit score into the blue zone, at more than 740 points:

11. Keep Your Credit Utilization Rate Low

Your credit utilization rate is a measure of how much of your available credit you’re using.

For example, if you’re able to borrow up to $1,000 dollars on a credit card and your balance is $250, your credit utilization rate would be 25%.

A high credit utilization rate will negatively impact your credit score. So, the general rule of thumb is never to let your credit utilization rate be more than 30%.

Money Advice on Savings

No list of personal finance tips would be complete without tackling savings. So, here’s some money advice on how to build up a nest egg.

12. Create a Savings Plan

The French writer and pioneering aviator Antoine de Saint-Exupéry said, “A goal without a plan is just a wish.”

Turn your wishes into goals by creating a savings plan (and – you guessed it – sticking to it).

Work out what you’re saving for and how much you plan to save every month. Then, try to get into a rhythm of putting money aside each month.

13. Use the 50/30/20 Rule

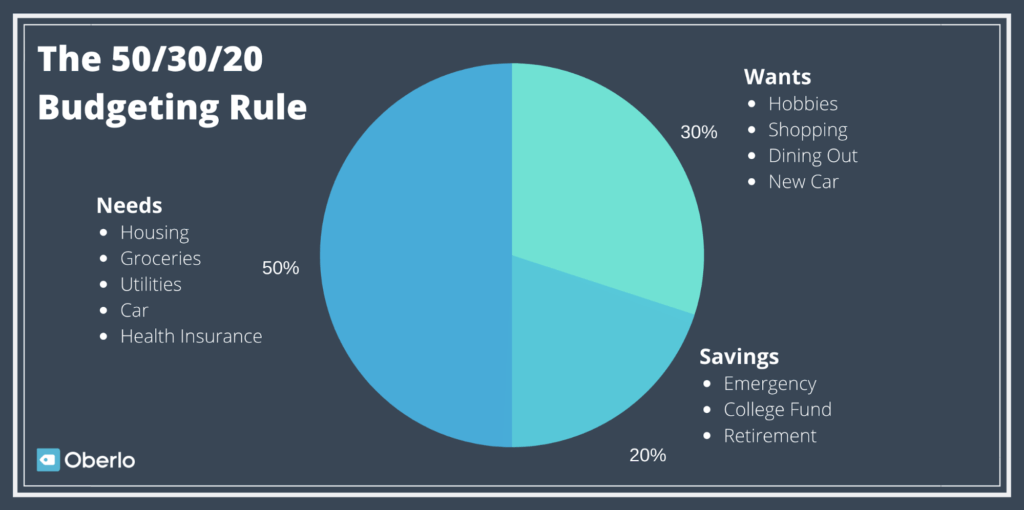

If you’re struggling with budgeting and saving, consider following U.S. Senator Elizabeth Warren’s 50/30/20 rule. The idea is to spend your income in the following way:

- 50% on needs, such as groceries, housing, utilities, and health insurance.

- 30% on wants, such as dining out, shopping, and hobbies.

- 20% on savings, such as emergency savings, a college fund, or a retirement plan.

14. Pay Yourself First

Here’s the idea: Don’t spend your money and save what’s left – instead, save first and then spend what’s left.

Personal finance expert Dave Ramsey said it best: “Saving must become a priority, not just a thought. Pay yourself first.”

15. Separate Your Savings

If you keep your savings in your checking account, there’s a good chance you’ll dip into them from time to time.

Avoid this common error by creating a separate savings account. Plus, some bank accounts pay a little interest on money held in savings accounts.

16. Cut Back on Expenses

It doesn’t matter how much you earn if you spend it all. So, try to cut back on expenses to boost the amount of money you can save and invest each month.

You could save money on big expenses such as housing by downsizing to a smaller property or moving to a cheaper area. Or you could cut back on the amount you spend on shopping and eating out.

Personal finance advisor Suze Orman said, “Look everywhere you can to cut a little bit from your expenses. It will all add up to a meaningful sum.”

Personal Finance Advice on Income

To learn how to manage your money better, you need to have some money in the first place! So, let’s explore some of the best finance tips when it comes to income.

17. Find Ways to Increase Your Income

You can budget, save, and be mindful of your spending until the cows come home, but eventually, you’ll hit a wall. Then, you’ll need to find a way to make more money to improve your financial situation.

I know, easier said than done…

Still, try to find ways to increase your income. Perhaps you could take a free online course to improve your skills. Or you could…

18. Start a Side Hustle

Starting a side hustle is a great way to boost your income if you need money. Plus, there are countless side hustle ideas out there. For example, you could:

19. Negotiate Your Salary

Arguably one of the easiest ways to boost your income is to do a good job negotiating your salary when starting a new job.

The rule to live by? Never share your current pay rate – get the potential employer to name a figure first. Then you can focus on pushing it higher.

20. Beware of Lifestyle Creep

When you start earning more money, beware a common trap called “lifestyle creep.” This is when the amount of money you spend increases alongside your income.

For example, when you get a raise, you might decide to buy a new car. Don’t. Resist lifestyle creep at all costs and focus on your savings and investing goals.

Money Advice on Investing

It’s the ultimate aim: earning passive income from money that makes more money for you. Here are some top personal finance tips to help you learn how to manage money better.

21. Take Responsibility for Your Financial Education

Adulting is hard. And when it comes to money, you’re responsible for improving your situation.

So, grab your finances by the horns and dedicate some time each week to learn more about money. Thankfully, there are plenty of great personal finance blogs out there.

As the American founding father, Benjamin Franklin said, “An investment in knowledge pays the best interest.”

22. Invest In Yourself

Before you start investing in stocks, you may want to invest in yourself.

Have you ever heard the expression, “your 20s are for learning, your 30s are for earning”?

The idea is that if you haven’t yet established yourself in a business or career, your money may be best spent on developing the skills and education that will allow you to increase your earnings over time.

Check out online course platforms like Khan Academy and Coursera, or free business courses like Shopify Compass.

23. Learn About Investing Options

There are countless investing options out there, such as 401Ks, real estate investment trusts (REIT), peer-to-peer lending, and stock market staples like the S&P and Dow Jones.

Make sure you understand the options available and their pros and cons before you give your money away.

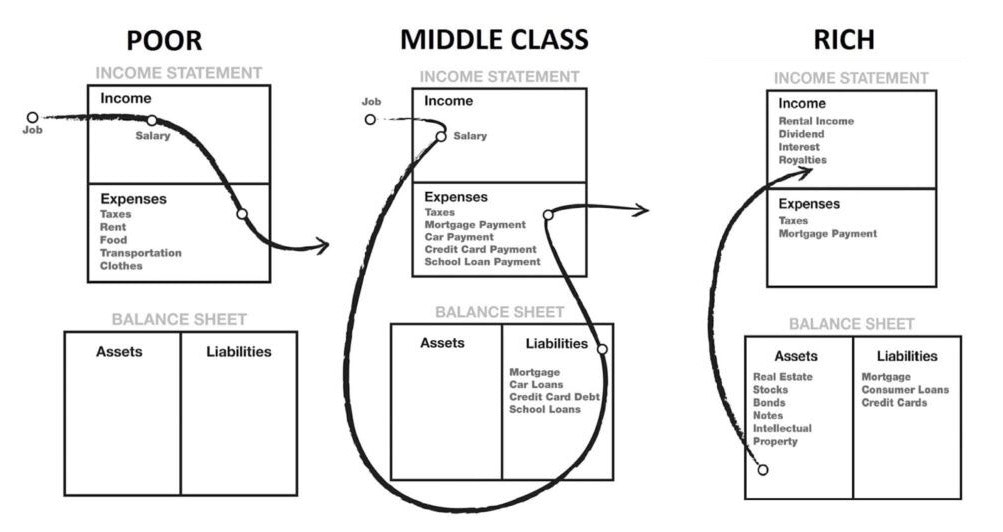

24. Invest in Assets, Avoid Purchasing Liabilities

This is one of the most essential money management tips out there.

In essence, an asset puts money into your pocket, and a liability takes money out of your pocket. Here’s a diagram to help explain this concept from the book, Rich Dad, Poor Dad:

Here’s the thing: The rich own assets and the poor don’t. In short, if you want to be rich, you need to buy assets, not liabilities. This concept can help you achieve financial freedom.

25. Start Investing Today

When it comes to investing, time is key.

Compound interest can revolutionize your finances over time, so start investing now and you’ll reap the rewards later. So, put your money to work for you now.

How to Be Smart with Money

Sometimes the most challenging part of personal finance is the “personal” part. So, here’s some money advice to help you learn how to get better with money.

26. Focus on Your Situation

Comparing yourself to others is a very effective way to make yourself miserable. There’s no point in “keeping up with the Joneses.”

Instead, focus on you and your financial situation – in this race, you’re only competing against yourself.

27. Learn How to Be Frugal, Not Cheap

The academic Elise Boulding said, “Frugality is one of the most beautiful and joyful words in the English language, and yet one that we are culturally cut off from understanding and enjoying.”

Here’s the thing: Frugality is empowering – the idea is to prioritize your spending. On the other hand, being cheap is the concept of trying to spend less on everything, all the time, no matter what.

In short, don’t be cheap, be frugal.

28. Create Personal Finance Goals

You can’t make your money work for you unless you have proper goals.

So, what do you want? An emergency fund? A house? How about a holiday? Whatever it is, write down your goals and then create a plan.

29. Take Your Values Into Account When Making a Purchase

The stage and film actor Will Rogers once said, “Too many people spend money they haven’t earned to buy things they don’t want to impress people they don’t like.”

Don’t be one of these people. Instead, carefully consider every purchase you make and ensure it fits with your values.

30. Discuss Finances with Your Significant Other

If you’re in a serious relationship, it’s a good idea to discuss your finances with your significant other.

Financial advisor Suze Orman said, “After you marry, every asset either of you acquires is jointly held. That’s why you both need to be in sync on your long-term financial goals, from paying off the mortgage to putting away for retirement. Ideally, you should talk about all this before you wed. If you don’t, you can end up deeply frustrated and financially spent.”

How to Manage Money Better: A Summary

Looking for some money advice? In summary, here are 30 personal finance tips to help you learn how to manage money better.

- Use budgeting apps like You Need a Budget, Mint, Wally, and EveryDollar

- Create a budget (and stick to it!)

- Create a financial calendar

- Track your net worth

- Don’t make impulse purchases

- Understand your debt

- Understand interest rates

- Pay off debt with the avalanche or snowball method

- Avoid debt and learn about credit

- Check your credit score and report regularly

- Keep your credit utilization rate low

- Create a savings plan

- Use the 50/30/20 rule

- Pay yourself first

- Separate your savings

- Cut back on expenses

- Find ways to increase your income

- Start a side hustle

- Negotiate your salary

- Beware of lifestyle creep

- Take responsibility for your financial education

- Invest in your skills and knowledge

- Learn about investing options

- Invest in assets and avoid purchasing liabilities

- Start investing today to take advantage of compound interest

- Don’t compare yourself to others, focus on your situation

- Be frugal, don’t be cheap

- Create personal finance goals (and then stick to them!)

- Take your values into account when you buy things

- Discuss your finances with your significant other

We’ve just covered a lot of personal finance tips, so if you’re feeling overwhelmed, take a breath! You don’t need to do it all at once. Go for small, consistent daily improvements over time.

Did we miss any personal financial management tips? Which personal finance tip resonated with you most? Let us know in the comments below!