Peer-to-peer lending began in 2005 when Zopa launched its online service. But it didn’t take off until the global financial crisis in 2008.

Why?

To manage the financial crisis, banks reduced their lending services, and central banks cut interest rates on savings. As a result, consumers needed a new way to borrow, and investors were looking for alternative opportunities to lend.

In the years since, peer-to-peer lending has taken the world by storm – and for good reason. This new type of loan can provide many benefits for borrowers and investors over traditional banking.

So, what is peer-to-peer lending, and can it benefit you?

In this article, you’ll learn what P2P is, how it works, and its pros and cons. Plus, we’ll tell you about five apps available in 2023.

Let’s get to it.

What is Peer-to-Peer Lending?

Peer-to-peer lending – also known as P2P lending – enables individual borrowers to obtain loans directly from individual investors. It’s an alternative to traditional sources of lending and credit, such as banks and credit unions.

How Does Peer-to-Peer Lending work?

Peer-to-peer lending platforms connect individual borrowers with investors. The platforms earn money from fees they charge borrowers and investors. Popular sites include LendingClub, Prosper, and Funding Circle.

Let’s take a closer look at the process of investing in P2P lending as well as how to get a peer-to-peer loan.

How to Invest in Peer-to-Peer Lending

- To get started, you’ll need to create an account on a peer-to-peer lending app.

- Then, you’ll be able to explore different loan options. The more sophisticated P2P lending apps typically grade loans to make it easier to weigh risk, and some even provide automatic investing tools.

- Next, you’ll need to choose an investment and allocate funds. You can generally either fund the entire loan or diversify your portfolio by funding a small portion of many different loans.

- Finally, you can log in to the peer-to-peer lending app to check your earnings and your investments’ progress. Then you can either reinvest any profits or withdraw them.

How to Get a Peer-to-Peer Loan

- Once you’ve identified the type of peer-to-peer loan you want, you need to choose a P2P lending site.

- Next, submit an application on the site – this will often result in a soft credit check.

- If your application is approved, you’ll need to review your offered loan terms and interest rate.

- If you’re happy with the terms, you can submit your loan listing to the platform and wait for investors to fund it. This is usually when a hard credit check happens.

- Once your peer-to-peer loan is funded, your funds will be deposited into your bank account, and you’ll need to keep up with the agreed repayment schedule.

3 Types of Peer-to-Peer Loans

It’s possible to get a peer-to-peer loan to fund virtually anything. All of them have financial risks associated with them which we talk about later in this article. However, there are three main types of peer-to-peer loans. Let’s take a closer look at them.

1. Personal Peer-to-Peer Loans

This type of peer-to-peer loan includes medical bills, car purchases, debt consolidation, home improvements, vacations, and other large purchases. The scope of peer-to-peer loans is often much broader than traditional financial institutions.

2. Education Peer-to-Peer Loans

Many people use peer-to-peer loans to fund their studies. These loans are typically lump sums that allow the borrower to pay down study expenses in whatever way they prefer.

3. Business Peer-to-Peer Loans

Small businesses often get peer-to-peer loans to help start or develop a business. These loans can be used to launch new products, invest in marketing campaigns, or expand the business by hiring new employees.

Unlike banks, peer-to-peer lending apps allow businesses to present their loan requests to many different investors at once, increasing the chances that their loan will be funded. You have estimate your loan repayments with a free business loan calculator.

5 Peer-to-Peer Lending Apps in 2023

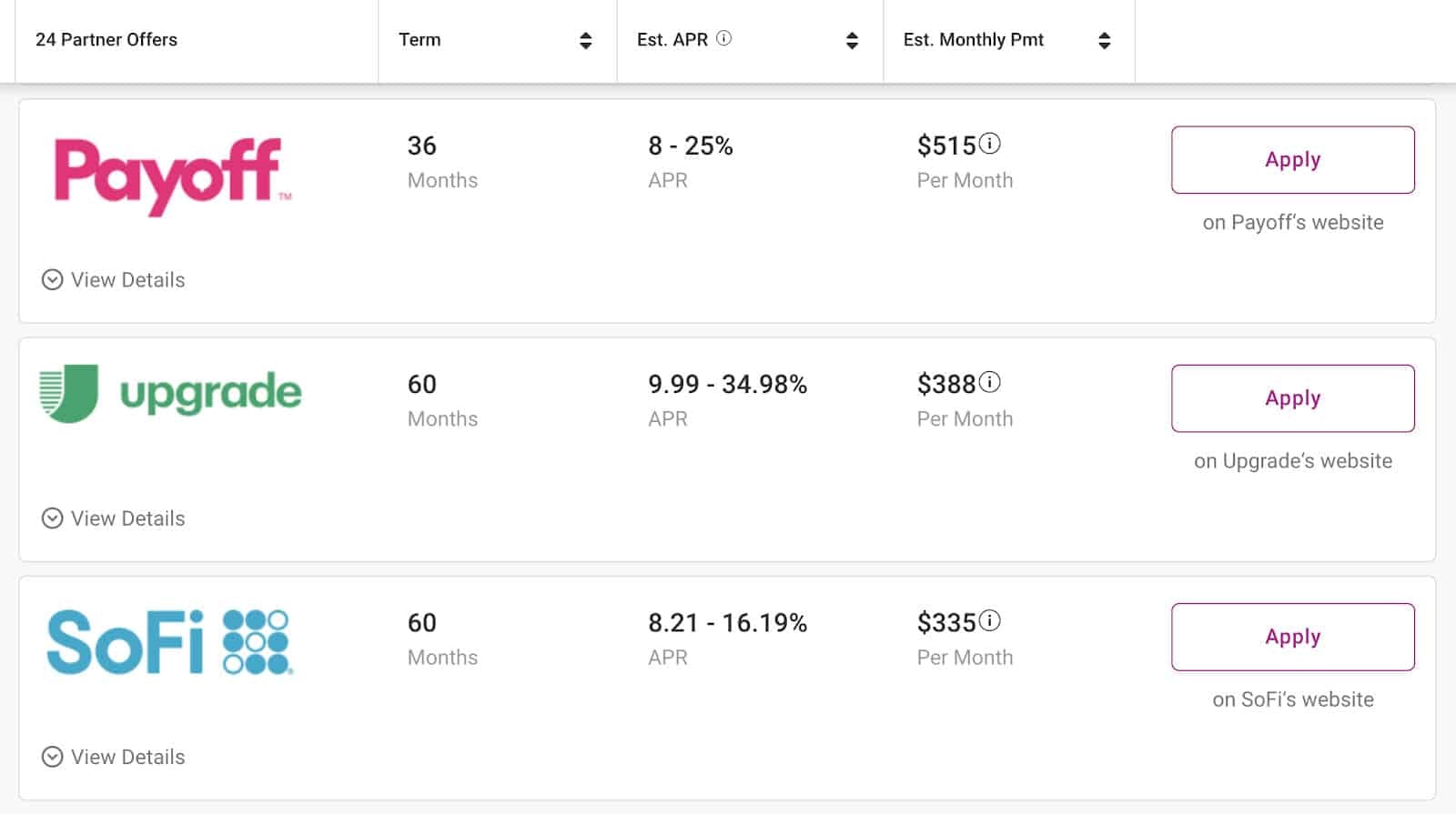

If you want to invest in peer-to-peer lending or get a peer-to-peer loan, you need to choose a platform to use. To jumpstart your search, here are five peer-to-peer lending apps on the market.

1. Upstart

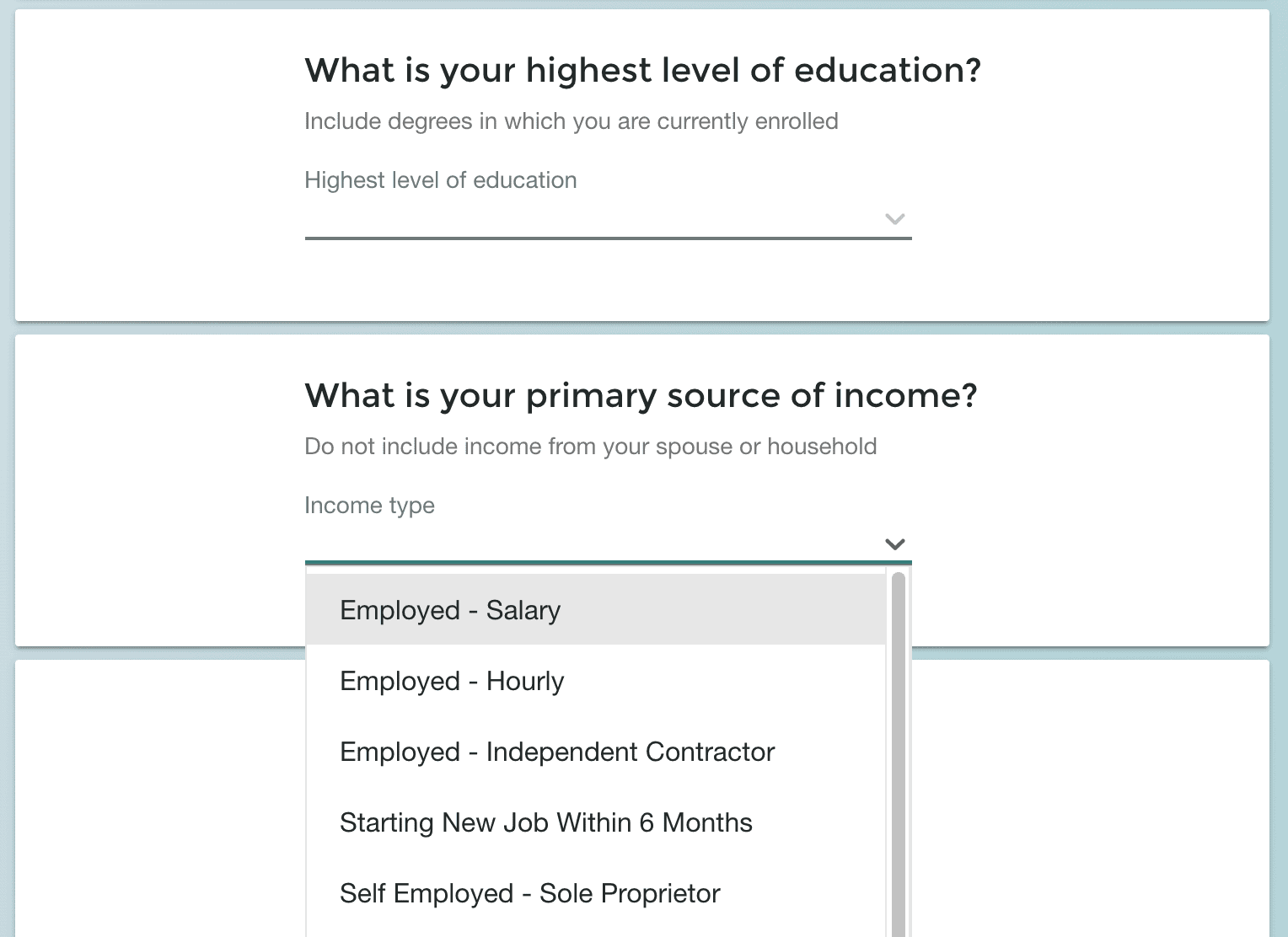

The Upstart peer-to-peer lending app began in 2012. Part of what makes Upstart such a popular platform is its unusual approach to evaluating borrowers. The company’s trademarked slogan is, “You are more than your credit score.” Upstart also takes into account the borrower’s academic performance, work history, and even potential earnings.

2. Prosper

Prosper has been operating since way back in 2005. Since then, Prosper claims that more than one million people have used the site to secure a loan, and individuals have invested more than $17 billion through the platform. Prosper facilitates a wide range of loans, from debt consolidation to medical bills.

3. SoFi

SoFi is short for ‘Social Finance.” This peer-to-peer lending app provides many types of loans, but it specializes in refinancing student loans. When applying for a loan, SoFi takes into account each borrower’s education and income potential. Investors can use SoFi’s app to manage all of their investments in one place, including stocks, exchange-traded funds (ETFs), and crypto.

4. Funding Circle

Funding Circle has been around since 2005 and focuses on small business loans. This peer-to-peer lending platform boasts a 6-minute online application process, and borrowers can sometimes receive a decision within 24 hours and funding within just three days. More than $10 billion has been invested through the platform.

5. Lending Club

Lending Club was founded in 2007, and more than $50 billion has changed hands through the platform. This peer-to-peer lending app helps to facilitate personal and business loans. Plus, borrowers can secure loans as small as $1,000 through the platform. Investors can also start with as little as $1,000.

The Advantages and Disadvantages of Peer-to-Peer Lending

There are many things to consider before investing in peer-to-peer lending or getting a peer-to-peer loan.

To help, here’s a rundown of the advantages and disadvantages of peer-to-peer lending for both investors and borrowers.

The Advantages of Peer-to-Peer Lending for Investors

- There’s Potential for a Relatively High Return on Investment

Peer-to-peer lending can provide higher returns than many savings accounts or traditional investing accounts.

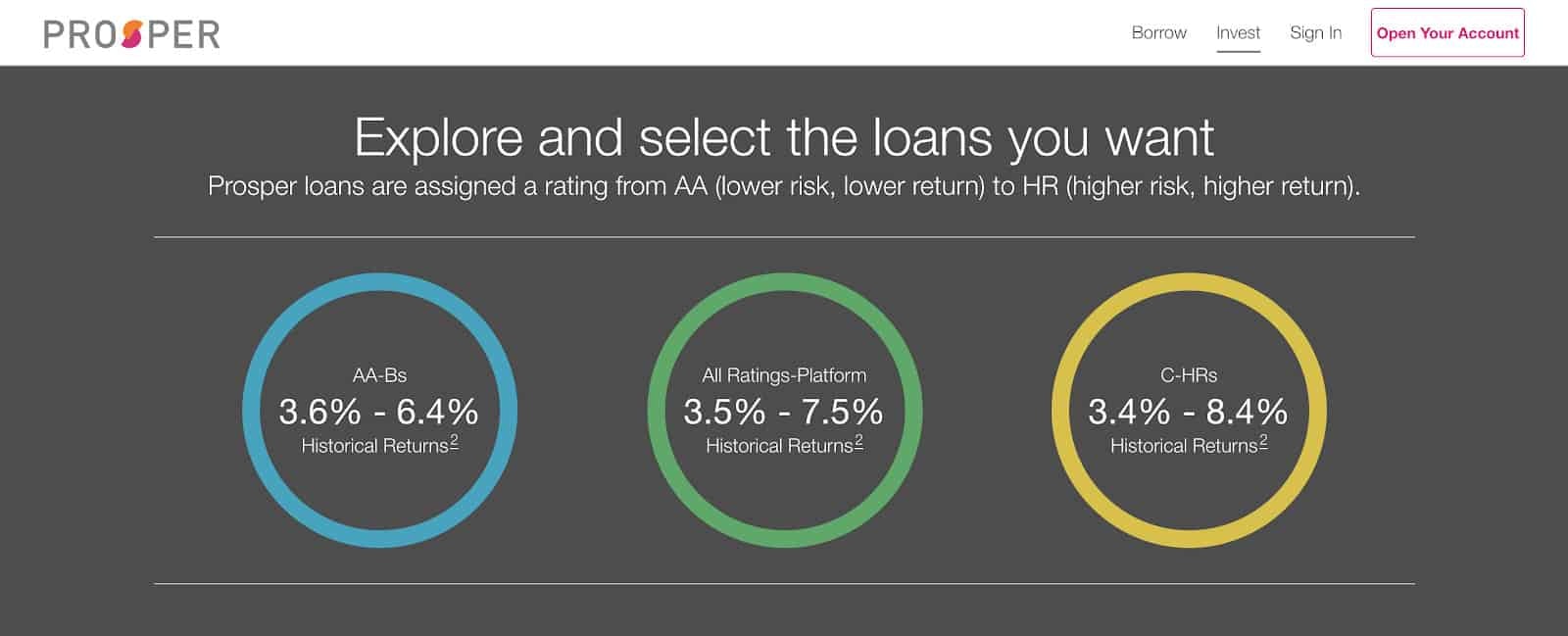

For example, Prosper’s peer-to-peer lending platform reports that it has provided average historical returns of 3.5% to 7.5%.

- Peer-to-Peer Lending Makes it Easy to Diversify Your Portfolio

Peer-to-peer lending apps make it very easy to spread your capital across multiple investments to reduce risk.

For example, instead of investing $10,000 into one loan, you could split that money up and invest $100 into 100 different loans. Then, you would only lose $100 if a borrower defaults. Plus, many sites allow you to invest as little as $25 or $50 into an individual loan.

The Disadvantages of Peer-to-Peer Lending for Investors

- Peer-to-Peer Investing Can Be Time-Consuming

Although investing in multiple peer-to-peer loans can help to mitigate risk, it can also be time-consuming to research and manage so many small investments.

Alternatively, there are automatic investing options available on some peer-to-peer lending sites. However, these services typically charge fees or take a cut of your profits.

- Investing in Peer-to-Peer Lending Carries Risk

As with any investment, there’s always risk involved. Although you can use ratings and credit reports to gauge risk, there’s never a guarantee that every borrower will repay their loan.

Essentially, investing in peer-to-peer lending requires you to take on the same risks as banks do when funding loans. Not all loans will be repaid and investors can lose their money.

The Advantages of Peer-to-Peer Lending for Borrowers

- Competitive Interest Rates and Fixed Monthly Payments

Perhaps the most significant benefit to peer-to-peer loans for borrowers is the interest rates.

If you meet the criteria, peer-to-peer loans can often carry lower interest rates than banks and credit unions. As a result, peer-to-peer loans can help you to save money – especially with debt consolidation loans.

What’s more, borrowers often have fixed monthly payments debited from their bank accounts. This helps to provide a sense of stability and security that many credit cards don’t offer.

- Peer-to-Peer Loans Can Be Very Accessible

Many peer-to-peer lending apps aren’t as rigid as banks and credit unions, and they judge borrowers on different criteria.

For example, the Upstart peer-to-peer lending platform takes your education and income type into account.

As a result, people who struggle to secure loans from traditional sources may find it easier to qualify for a peer-to-peer loan.

- The Process Can Be Quick and Simple

Thanks to the streamlined process created by peer-to-peer lending apps, applying for a loan can be quicker and easier than traditional channels. It can often take only a few minutes to find out if you’re eligible, and as little as two or three days to secure a loan.

Although investors will see your loan request’s details, your personal information won’t be disclosed in many peer-to-peer lending apps.

- Many Peer-to-Peer Lending Apps Use Soft Credit Score Inquiries

Another key benefit to peer-to-peer borrowing is that many platforms use soft inquiries to check your credit report when conducting pre-approval screenings. These soft inquiries don’t affect your credit score – it’s the same type used when you check your score.

As a result, you can usually find out the loan amount and interest rates that you qualify for, without the process affecting your credit score. Once you accept a peer-to-peer loan offer, the platform will typically make a hard inquiry before your loan is officially approved.

In contrast, most traditional lenders make hard inquiries as soon as you apply for a loan, which lowers your score slightly and remains on your credit report for up to two years.

- You’re Free to Shop Around for the Best Deal

Peer-to-peer lending’s speed and simplicity make it very easy to shop around for the best deal.

Also, soft credit inquiries make it possible to compare different offers from peer-to-peer lending apps without lowering your credit score – this typically isn’t possible with traditional loans.

You can even use loan comparison tools, such as Experian’s Loan Referral Tool.

The Disadvantages of Peer-to-Peer Lending for Borrowers

- If You Miss Payments Your Account May Be Sent to Collections Faster

Just like traditional sources of lending, peer-to-peer lending apps report payment details to credit bureaus. So paying on time can help to improve your credit score, and missed or late payments can lower your score.

Some websites suggest that peer-to-peer lenders can be quicker to submit overdue payments to third-party collection agencies than more traditional loan sources. As a result, a missed payment could have a much larger impact on your ability to borrow money in the future.

- Ease of Securing Loans Could Lead to Financial Difficulties

Because peer-to-peer loans are so accessible, it can be tempting to borrow more money than you need. Plus, if you qualify for a larger loan than you requested, some peer-to-peer platforms will encourage you to borrow the full amount.

Summary: Peer-to-Peer Lending

Peer-to-peer lending is a web-based alternative to traditional sources of lending and investing. It’s facilitated by platforms that enable borrowers to secure loans from multiple individual investors.

In summary, here are five peer-to-peer lending apps in 2023:

There are many advantages of peer-to-peer lending. Borrowers can experience lower interest rates than traditional sources of lending, such as banks and credit unions. Also, it can typically be easier to apply for and secure loans. Plus, investors may see higher returns than many other forms of investing and saving.

If you’re considering investing in peer-to-peer lending or applying for a peer-to-peer loan, make sure to do your due diligence or talk to a qualified professional financial advisor.