PayPal’s great, but it’s far from the only option out there.

So why would you want to check out PayPal alternatives? Well, here are some key drawbacks to the payment solution:

- PayPal doesn’t provide protection for sellers selling digital products and services.

- Many PayPal alternatives charge lower fees than PayPal’s 3.49 percent plus US$0.49.

- PayPal has been known to freeze accounts for up to six months without prior warning.

- It can take a long time to withdraw money to your bank account – three to five days can be the standard.

So if you’ve ever found yourself asking, “What can I use instead of PayPal?” we’ve got you covered.

In this article, you’ll learn all about the best PayPal alternatives available to help you decide which one is best for you and your business.

The Best PayPal Alternatives

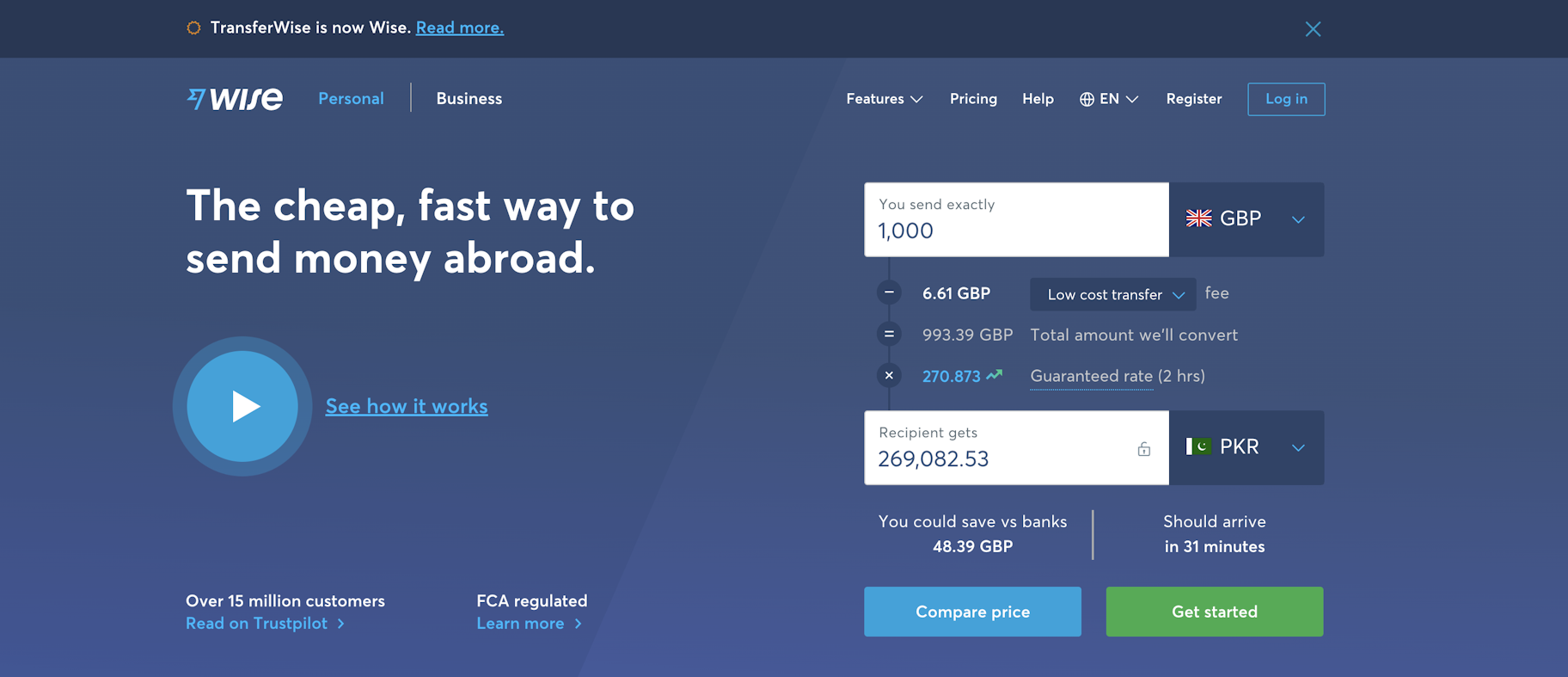

#1: Wise (formerly Transferwise)

Best for: Individuals and service-based businesses with a high volume of international transactions.

Wise dubs itself as “a cheaper way to send money internationally” and is a fantastic PayPal alternative if you make lots of international transfers.

The payment solution claims to provide the “real” exchange rate, without inflating it with additional unseen fees. In one transaction of $2,000, Wise cost a UK recipient £106.47 less than PayPal.

But that’s not all.

The service’s Borderless multi-currency account provides users with a debit card, allows you to manage money in more than 40 currencies, run payroll, batch payments, charge clients, and more.

Plus, with Wise for business, you’re able to invoice your customers in their own currency.

So how can TransferWise provide such low fees for international transfers?

Here’s how it works: Let’s say you want to send $1,000 to your friend in the UK. Your $1,000 would be deposited into Wise's American account. Then, they would send your friend the equivalent in British pounds from Wise's UK account, using the real exchange rate.

In essence, the money never actually crosses borders! This also makes international transfers extremely fast.

Pricing: Opening an account is free, and the fee for sending money starts from 0.41% . (Learn more here).

#2: Google Pay

Best for: Quick, easy, and free payments from a well-known brand.

This service is a fast, simple way to pay on websites, in apps, and in-store using cards saved to your Google account. Simply add your credit and debit card payment details to your account, and enjoy faster, more convenient payments, wherever you are.

Google Pay enables businesses to streamline the payment process for customers.

Plus, businesses can also use Google Pay to deliver special mobile offers and recommendations to customers, and provide gift cards.

The best part? This payment solution is largely free for customers and businesses.

Pricing: Debit cards and bank transfers are free. Credit cards are charged at 2.9 percent of the transaction amount.

#3: Stripe

Best for: Businesses wanting an intuitive and flexible API (application programming interface).

This payment solution believes payment problems are “rooted in code, not finance” and they consider themselves a “developers first” business.

For this reason, the service is easy to integrate and customize using their simple API. And it’s no surprise that many large digital business tools like Shopify have fantastic Stripe integrations. There are more details about Shopify payment integrations, right here.

You can accept payments from all over the world. Stripe automatically deposits your money into your bank account – plus, mobile payments are available.

The downside? Unfortunately, the transaction fees are very similar to PayPal’s.

All in all, Stripe’s strength lies in its flexibility and customizable nature. However, this could be an issue for those with little programming knowledge.

Pricing: Stripe charges 2.9 percent of the transaction value plus $0.30 (Learn more here).

#4: Payoneer

Best for: Small to medium-sized businesses looking for an all-around solution.

It’s particularly good for small and medium-sized businesses. In fact, this PayPal alternative places a special focus on market sectors such as ecommerce, online advertising, freelancing, and vacation rentals.

Like TransferWise, Payoneer provides a debit card to go with their online account, so you can withdraw funds from your bank or ATMs worldwide.

Unlike Stripe, this service doesn’t require any programming knowledge and it doesn’t take long to set up an account.

Payoneer’s pricing is simple too.

The payment solution bills your fees monthly and transactions are free between Payoneer accounts.

Unfortunately, credit card transaction fees are slightly higher than some other services, and you generally have to pay a fee when transferring money to a bank account.

Pricing: Payments from other Payoneer customers are free. Credit card transactions from customers are charged at 3 percent, and eChecks are charged at 1 percent. (Learn more here.)

#5: Shopify Payments

Best for: Ecommerce businesses using the Shopify platform.

Although this tool is only useful if you have a Shopify store, it’s worth bearing in mind if you’re looking to progress in ecommerce. Why?

Because this PayPal alternative makes payments extremely easy for sellers.

It’s completely integrated with your Shopify store, simple to get started, and allows you to accept all major credit cards. Plus, customers can sign up with Shopify Pay to make checkout easier.

Shopify Payments also works with Facebook shops, Pinterest Buyable Pins, Facebook Messenger, Amazon, eBay, and more.

What’s more, if you decide to sell in person, you can take card payments with Shopify POS (point of sale).

Pricing: Plans start at $39 per month for a basic Shopify account and credit cards are charged at 2.9 percent plus $0.30. (Learn more here.)

#6: Authorize.Net

Best for: Small businesses wanting incredible customer support and security.

The service is a subsidiary of Visa and has the best user support in the business – provided free, from real people, 24/7.

The payment solution has also been repeatedly praised for its reliability and security.

Businesses will also be glad to know the service provides invoicing, recurring billing, point-of-sale checkout, and a robust API.

The interface is intuitive, and the service also integrates with other payment providers, such as Visa Checkout, PayPal, and Apple Pay.

However, this PayPal alternative isn’t particularly good for personal use as you don’t have the ability to send and receive payments from family and friends.

Pricing: Plans start at $25 per month gateway fee, and 2.9 percent plus $0.30 per transaction. (Learn more here.)

#7: Square

Best for: Businesses focused on selling in-person.

The point-of-sale service is incredible, allowing you to accept cards, cash, checks, and even gift cards. You can also print receipts or send them to customers online. When you sign up, you’ll receive your free reader to get started.

What’s more, you can even swipe cards without an internet connection.

This PayPal alternative also provides invoicing, recurring payments, real-time inventory management, and payroll tools.

Square Checkout integrates with your ecommerce store and allows you to accept payments online using a simple checkout workflow.

Pricing: Point-of-sale transactions are charged at 2.75 percent, with other fees for different types of transactions. (Learn more here.)

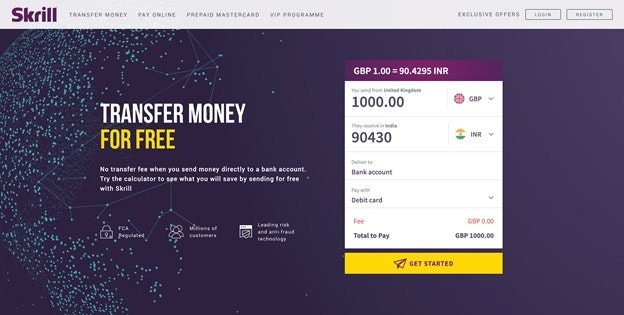

#8: Skrill

Best for: Those who deal in cryptocurrencies or play games online.

The service is incredibly simple to use.

You can send and receive money, store your card details for faster purchasing, link your bank accounts, and make payments with just your email address and password.

The payment solution also provides a prepaid debit card that you can use around the world. Plus, moving money to your bank account takes no time at all.

Skrill was created with cryptocurrencies in mind, like Bitcoin, Ether, and Litecoin. It’s also set up for gambling and other online games which require funds.

Like PayPal, the service’s strict fraud prevention tools have been known to inconveniently freeze user’s accounts.

The main benefit is the low fees.

Pricing: Skrill charges 1.45 percent plus $0.50 to send and receive funds – withdrawing money to a bank account is free. (Learn more here.)

#9: Braintree

Best for: Large businesses and corporations.

It’s geared for large businesses, with companies like Uber, DropBox, GitHub, and Yelp using the payment solution.

The main benefit of Braintree is their focus on helping businesses to reduce friction and “increase conversions with a seamless checkout experience.”

Braintree makes it easy to accept online payments in more than 130 currencies from more than 45 countries.

The service provides a host of advanced features that PayPal lacks.

It also has all of the standard features a larger business would expect, such as recurring billing and hands-on customer support. The system integrates well with PayPal, as well as other large payment providers such as Apple Pay and Google Pay.

Due to it’s customizable nature, you’ll need programming knowledge to integrate it with your website.

Pricing: Standard pricing is 2.9 percent plus $0.30 per transaction, although custom pricing plans are available on request. (Learn more here.)

#10: Dwolla

Best for: Serious U.S.-based businesses with a high volume of bank transfers.

This PayPal alternative is extremely developer-friendly and can integrate with your application. It also has a white-label API that allows businesses to customize the branding of the checkout experience.

These branding tools are powerful and simple to implement.

Built for volume, Dwolla will automate your payments and send up to 5,000 secure payments in a single API request.

Plus, the service is extremely reliable, with a 99.9 percent uptime.

It also provides very strong security and a hands-on customer success team.

It’s one of the best solutions if you plan on sending and receiving a high volume of bank transfers, as the payment solution actually specializes in ACH bank transfers. (“ACH” is short for Automated Clearing House – these are electronic, bank-to-bank transfers).

Unfortunately, Dwolla is only available in the U.S. and so it isn’t well-suited to those with international needs.

Pricing: The Starting plan charges 0.5 percent of the transaction amount, with a minimum of $0.50 and a maximum of $5.00. The Scale plan starts at $2,000 per month with custom plans available on request.(Learn more here.)

#11: Quickbooks Payments

Best for: Freelancers and other small service-based businesses who also need a professional accounting tool.

This PayPal alternative caters to small businesses and is focused on providing simple, intuitive financial tools and fast transactions.

So what can it do?

It allows you to create and send invoices, set up recurring billing, take mobile card payments, accepts ACH bank transfers, and set up automated payment reminders.

You can also link your bank accounts with Quickbooks to make accounting easier and avoid entering data manually.

What’s more, you can connect your payments with payroll and timesheets.

Pricing: Quickbooks Payments have a number of different pricing plans depending on your needs. The basic pay-as-you-go plan provides free bank transfers and card payments charged at 2.9 percent plus $0.25. (Learn more here.)

#12: 2CheckOut

Best for: Businesses that need a single payment provider that works with many currencies, countries, and languages.

In fact, the service supports eight payment types, a whopping 87 currency options, 30 languages, and more than 200 countries. So wherever your customers are, you should have no problems accepting payments!

The checkout experience is tailored for different countries, and you have the option of customizing it further.

The service also lets you accept 45 payment methods.

2CheckOut’s U.S. fees are the same as PayPal’s, but there are lower fees for international transfers overall.

Plus, the security is tight with more than 300 fraud checks per transaction.

Pricing: 2CheckOut provides three pricing plans depending on your needs. Transactions charges begin at 2.9 percent plus $0.30. (Learn more here.)

Apps: iOS

#13: Amazon Pay

Best for: An all-around, trusted payment solution with brand appeal.

Amazon users can simply log into their accounts, use their saved payment details, and check out using an same interface they already know and trust.

This helps to expedite the payment process and reduce friction, which is likely to improve your conversion rate.

Amazon Pay is available on all devices, allowing you and your customers to manage payments wherever it suits you.

Also, the transaction fees and fraud protection are much the same as PayPal’s.

You’ll need programming knowledge to integrate the payment solution with your online store and CRM (customer relationship management).

Pricing: Amazon Pay charges 2.9 percent plus $0.30 for domestic U.S. transactions, and 3.9 percent plus $0.30 for cross-border transactions. (Learn more here.)

Summary: The Best PayPal Alternatives

PayPal has its perks and strengths, but there are plenty of great alternatives out there for you to consider. Many of these have lower fees or features better suited to different needs.

To finish, here’s a roundup of the best PayPal alternatives along with our thoughts on what each payment solution is best suited to:

- Wise: Best for individuals and service-based businesses with a high volume of international transactions.

- Google Pay: Best for quick, easy, and free payments from a well-known brand.

- Stripe: Best for businesses wanting an intuitive and flexible API (application programming interface).

- Payoneer: Best for small to medium-sized businesses looking for an all-around solution.

- Shopify Payments: Best for ecommerce businesses using the Shopify platform.

- Authorize.Net: Best for small businesses wanting incredible customer support and security.

- Square: Best for businesses focused on selling in-person.

- Skrill: Best for those who deal in cryptocurrencies or play games online.

- Braintree: Best for very large businesses and corporations.

- Dwolla: Best for serious U.S. based businesses with high volumes of bank transfers.

- Quickbooks Payments: Best for freelancers and other small service-based businesses who also need a professional accounting tool.

- 2CheckOut: Best for businesses that need a single payment provider that works with many currencies, countries, and languages.

- Amazon Pay: Best for an all-around, trusted payment solution with brand appeal.

Which PayPal alternative is best suited to your needs? Did we miss a great payment solution? Let us know in the comments below!

Want to Learn More?

- Everything You Need to Know About PayPal and Other Payment Gateways

- How to Manage PayPal Claims, Disputes, and Chargebacks

- How to Set Up a Facebook Shop: The Quickstart Guide for Beginners

- 47 Mobile Marketing Apps to Drive Your Business From Anywhere

- 23 Inspirational Videos That Will Completely Blow You Away