When it comes to startups and small businesses, you hear a lot of talk about bootstrapping and self-funding. While this works out for some, it’s not the only way to build a successful company. There are tons of incredible entrepreneurs who have relied on small business loans to jumpstart or supercharge their growth.

There’s a conundrum when it comes to business ownership: you need capital to really get up and running, but you also need to be up and running to generate capital. A small business loan can be a great option for those who need some immediate cash to inject into their company.

If you’re new to how these loans work and wondering whether it’s the right idea for your unique situation, you’re in the right place. We’ll look at considerations, as well as how to get a business loan.

Reasons to apply for a business loan

At the end of the day, the number one reason entrepreneurs seek a business loan is because they don’t have enough money to run the business the way they want or need to. This might show itself as:

- Not enough money for day-to-day expenses, like inventory or operations

- A need for top-level employees with high levels of skill and experience, who will cost more than entry-level team members

- Trouble buying the equipment you need, depending on the type of business you’re running

- The need for a bigger advertising budget to make sure you can actually generate the business you need to grow

- Lack of an emergency fund in case something unexpected happens

If any of these apply to you, you may be one of the small business owners in a prime position for a business loan.

How to get a business loan in 6 steps

→ Click Here to Launch Your Online Business with Shopify

1. Calculate your requirements

One of the trickiest parts of the small business financing process is figuring out how much money you should take out in loans. If you take too little, you might not reach your goals. If you take too much, you may have trouble repaying.

You’ll need to work through all the possible items you need to cover, like:

- Equipment for a new store

- Costs to grow or expand

- Real estate costs

- Operating expenses

- Refinancing other loans

- Commercial insurance

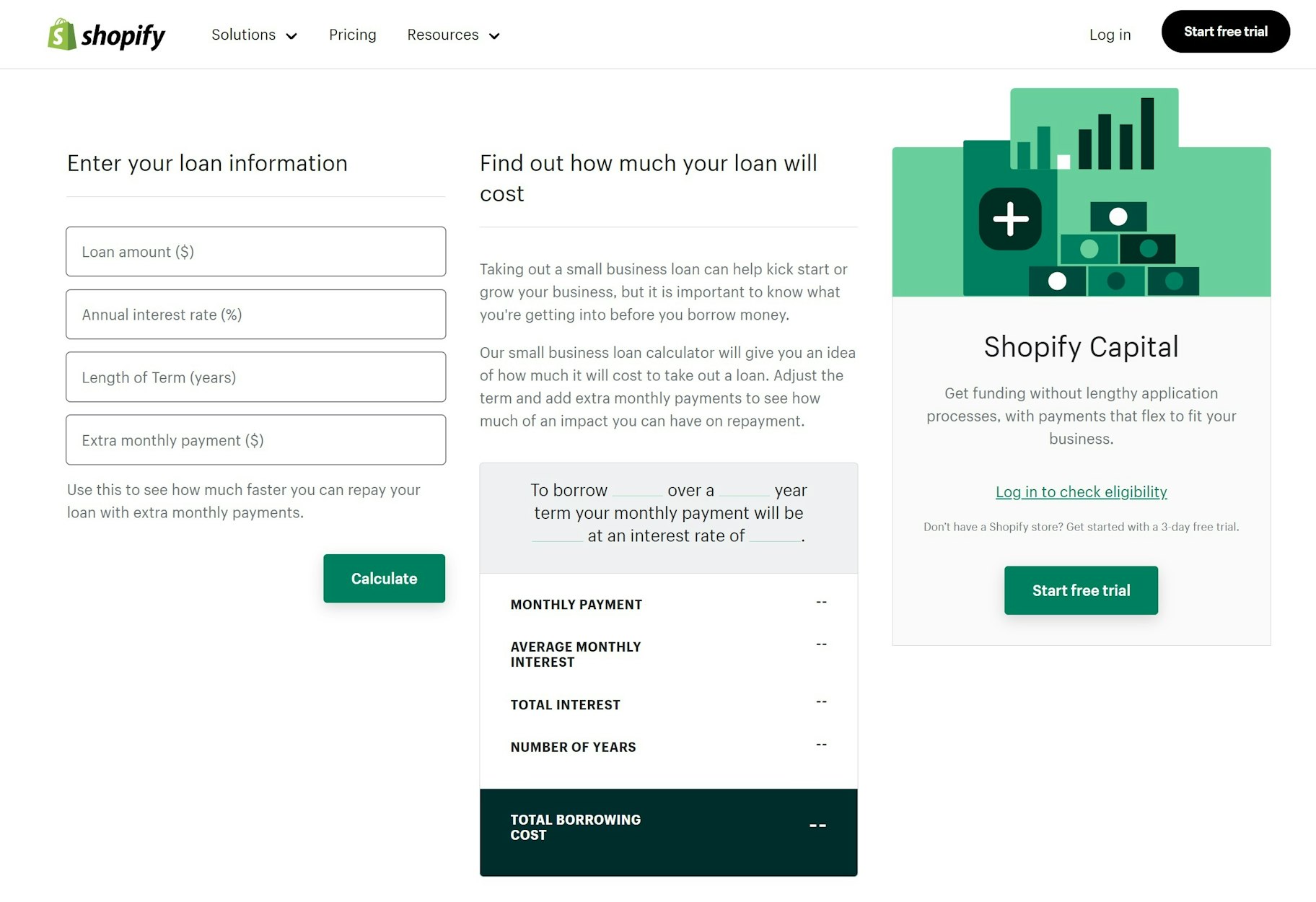

Try using a business loan calculator to help visualize the details of your loan, including your total amount, interest rate, and length of the loan term. These can be used to determine how much you’ll need to pay off per month.

Source: Shopify's Free Business Loan Calculator

2. Write a business plan

Business lenders likely won’t shell out any money if you don’t provide them with a strong business plan. This is essentially the document you’ll use to explain your long-term growth plans, including how you plan to use the loan money you receive, and how that will translate into business growth and repayment.

Here are the basic sections that your business plan should cover:

- A description of your company and core team

- Your core business model and how you operate

- The products and/or services you offer

- An analysis of your industry and market, and how your business fits in

- SWOT analysis: strengths, weaknesses, opportunities, threats

- The tools and processes you use for marketing and sales generation

- Your funding request and how you plan to use it

- An estimated projection of your finances over the next few years

Note: Many new online lenders have shortened the application process and don’t require a business plan, but keep in mind that these lenders often charge higher interest rates.

3. Consider repayment terms

Next, decide how you’ll repay the loan. Come up with a realistic figure for monthly payments. You’ll want to consider external factors such as social changes, supply chain interruptions, and market lulls.

Lenders will determine your monthly payments based on the following factors:

- Loan type

- Credit history

- Business type and how long it’s been active

- Business owners income

- Business profitability

Small business lenders are aware that every business is unique, which is the reason they offer multiple loan options. It is crucial to understand the repayment period for the loan you plan on taking out.

Here are some common loan types and their average repayment duration:

- Term loans: lasting up to 10 years

- SBA loans: working capital and fixed assets can be repaid in up to 10 years

- Microloans: with a repayment period of up to six years

- Invoice financing: repayable within a few months

- Business lines of credit: repayable up to five years

- Equipment financing: repayable up to 10 years

Note: Some lenders have prepayment penalties, which apply when a borrower makes an early payment. Check this with your lender—you don’t want to spend extra to get yourself out of debt.

4. Consult a financial adviser

This option isn’t 100% necessary if you’re willing to do the research on your own—but it’s a strong recommendation. Consulting a financial adviser can be a helpful way to get a true view of your cash flow, what makes sense for your loan, and how you can develop a plan to ensure you’ll be able to hit your monthly repayments on time.

And with tons of options to choose from, a financial adviser can help you narrow down which credit unions or business lenders you should choose based on your company’s circumstances and needs.

5. Decide on a type of loan

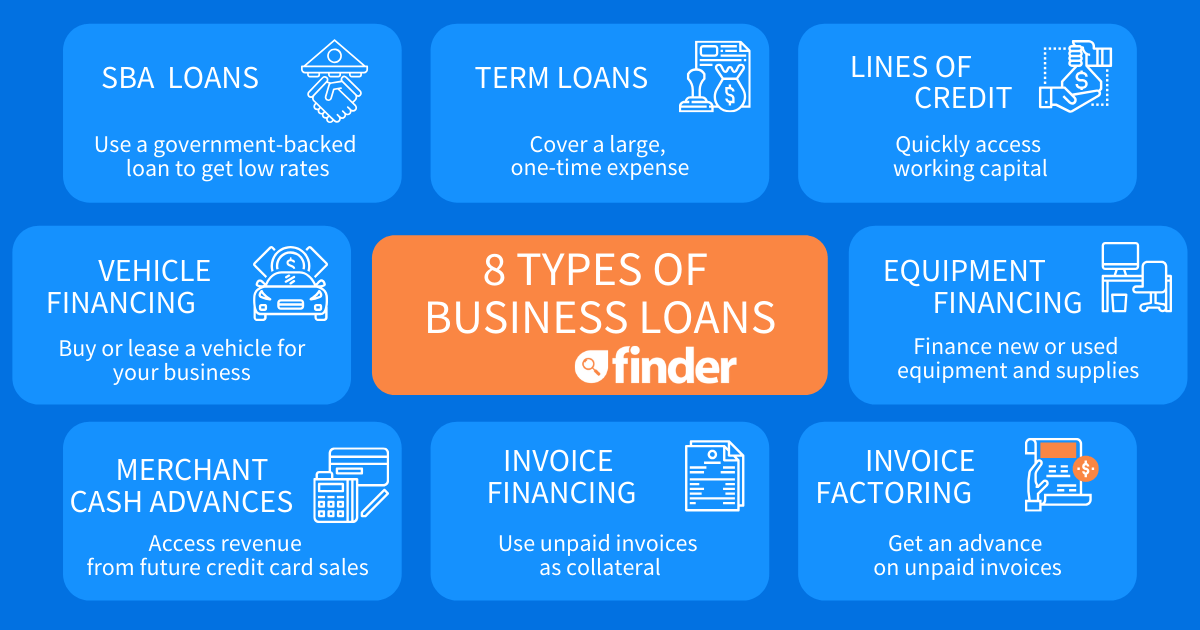

There are several types of loans to choose from, and there’s no single right choice. It all depends on what your business needs and which options are the most suitable for you. A few of the most popular loan types include:

- Term loans: Typically for larger loan amounts. Offered on a term of two to 10 years. Many require proven profits, which may not be possible for newer businesses.

- Small Business Administration (SBA) loans: Similar to a term loan from a private business lender, but the SBA offers more opportunities for under-serviced populations, like women and people of color.

- Online loans: Short and long-term loans offered for businesses that don’t have a solid track record, like startups or businesses with bad credit.

There are also less traditional types of loans, like invoice factoring. This is suited for businesses that rely on invoices to earn income, which may take a while for clients to pay off.

6. Apply for the loan

After you’ve done your research and identified a suitable loan, it’s time to apply.

Pick a lender

A conventional lender can be an option if you have a good credit score and small business finances. In case you don’t meet these requirements, you can look online for less traditional loan options, such as a merchant cash advance.

Approval ratings vary among different lenders. According to Biz2Credit’s latest Small Business Lending Index, the following are the loan approval rates for lender type:

- Small banks: 21.2%

- Big banks: 14.5%

- Credit unions: 20.2%

- Institutional lenders: 25.9%

- Alternative lenders: 27.6%

Select a financial institution that’s offering the loan you want and will pay it out within the timeframe that works for your business.

Gather your documents

A lender will provide you with a list of necessary materials for processing your application. Each lender may have unique requirements, but it's typically a variation of the following items:

- Business information, including business plan, name, address, and tax ID.

- Financial statements for both personal and business purposes, like tax returns, bank statements, credit card bills, pay stubs, balance sheets, lease agreements, business assets, and other related documents.

- Details about business owners, such as personal info of anyone having more than 20% to 25% ownership of a company.

Submit your application

The process and instructions for turning in an application will vary between lenders. Interviews are a common part of the application process. It could mean setting up a phone interview or going to a bank branch. Follow the instructions of your lender.

During the interview, you can ask the lender how long it usually takes them to process applications so you know when to expect a response. Plus, follow up as needed after the submission.

Weigh your options before getting a business loan

As you likely already know, a small business loan is something that needs to be taken seriously. It’s a big decision for a growing brand—it can even be the make-or-break that decides if that brand can stay afloat.

Be sure to consider all the pros and cons, especially your long-term plan for growing your profits and being able to pay back the loan on time. When you approach it with a solid plan, you’re massively increasing your chances for success.

Small business loan FAQ

What is the average amount of a small business loan?

- The average amount for a business line of credit loan is $22,000.

- The average amount for a short-term business loan is $20,000.

- The average amount for a medium-term business loan is $110,000.

- The average amount for an SBA loan is $107,000.

What are the chances of getting a small business loan?

BizCredit’s latest report cites the following loan approval ratings for different lenders:

- Small banks: 21.2%

- Big banks: 14.5%

- Credit unions: 20.2%

- Institutional lenders: 25.9%

- Alternative lenders: 27.6%

How do you qualify for a business loan?

- Updated business plan

- Two years or more in operation

- Low debt-to-income ratio

- Healthy credit report

- Collateral to secure the loan